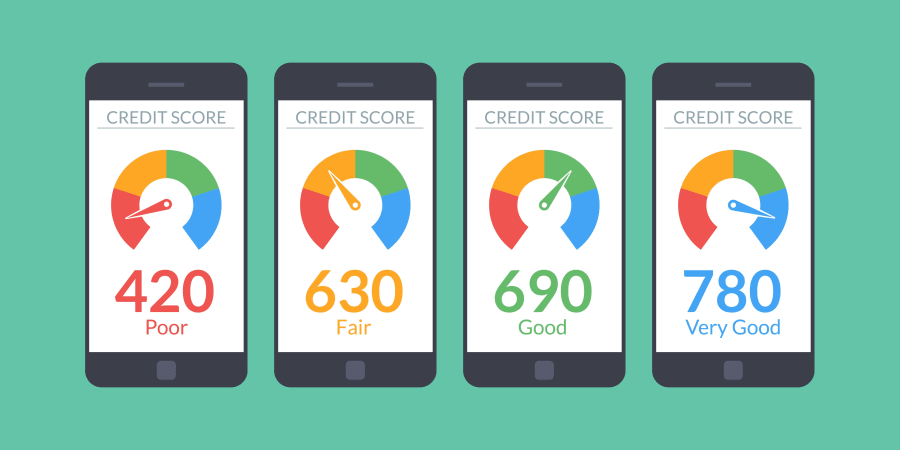

"I have been trying for a while, but my credit score simply won’t improve." - If you have said or thought this any time recently, you might be doing something wrong. And you might not even know what you’re doing wrong. The fairly obvious reasons might be unpaid loan EMIs or overdue credit card bills. If you already know this, the smart thing to do is to repay those bills and then check if it affects your score. If you have already tried that and it didn’t work, here are 7 other shockingly simple reasons that your score is not improving:

- Not checking your credit score before you apply for a home loan: This is one of the most common reasons why credit scores don’t improve, and in most cases actually get lower. Not many people are aware of the influence of a credit score over a home loan application approval. When you apply for a loan, most of the time people don’t check their credit score before they apply for loans. A low credit score results in rejection of the loan application, which further results in a lower credit score than before. A credit score more than 750 greatly increases the chances of your home loan application getting approved. By checking your score before you start applying for home loans saves you the rejection and doesn’t hurt your credit score. If your credit score is not the best it can be, it is advisable to wait for a few months to improve your credit score before applying. Applying in a rush and getting rejected is not worth the risk.

- Checking your payment history: Your payment history has a 35% impact on your credit score. When you get your credit report, make sure you go through it carefully. You might think that a single or few late payments might not have an impact on your credit score, but that is downright wrong. Late payments of credit card bills, unpaid loan EMIs and loan defaults among others are some of the most common reasons that lead to a low credit score. If you already have a low credit score, even a slight default or delay in bill or EMI payments can drag your credit score down even more. If you ignore your poor credit score for too long and do nothing to fix it, you will definitely have a lot of trouble while applying for a loan or credit card of any kind.

- Credit Utilization Ratio: Credit Utilization Ratio or CUR is the reflection of your credit card usage with respect to the available spending limit. For example, if your credit card limit is Rs. 10,00,000, and you spend about Rs. 5,00,000, your credit utilization ration is 50%. This ratio is used by banks and NBFCs to assess your credit managing capacity and spending habits. The Credit Utilization Ratio is another major factor that affects your credit score, but most people tend to ignore it. It makes up 30% of your credit score. A higher credit utilization ratio may indicate that the cardholder consistently faces a cash crunch, or is in the habit of spending compulsively. It may also indicate a greater possibility of the cardholder defaulting on monthly payments, which has a negative impact on the credit score. Therefore, credit card holders must ensure a low CUR.

- Age of Credit Line: Age of credit refers to the average age of all your currently open loan and credit card accounts. It has a 15% impact on your credit score. A longer credit history or older age line indicates that you have been a responsible borrower. The amount of time you have been using credit has a great impact on not just your credit history, but also on the officer approving your credit report. A long credit history indicates that you have been servicing debt over a long period of time and also have been making timely payments, and you are more likely to have a higher credit score.

- Total Number of Accounts: The total number of open and closed loans you have also greatly affects your credit score. This includes secured credit lines (like a home loan or car loan) and unsecured credit lines (like credit cards or a personal loan). Your total number of accounts has a 10% impact on your credit score. This 10% may not seem like much, but it has a much larger impact if you already have a poor credit score. An unsecure loan is the most expensive form of credit. The higher the number of unsecured loans you have, the more you have to pay due to the high interest rates. This means a higher chance of payment defaults. A person with more unsecured loans usually has a lower credit score as compared to a person with more secured loans.

- Credit Enquiries: A credit enquiry is a query raised by a bank while they assess your credit report. There are 2 types of credit enquiries – hard enquiries and soft enquiries. Hard enquiries have a 10% impact on your credit score. Keep in mind that when you inquire about your credit score it is called a soft enquiry and not a hard enquiry. Thinking that more number of accounts means a better credit score, people apply for multiple loans. This could negatively impact your credit score in a huge way. Banks are wary of people who constantly apply for loans or who have recently been sanctioned a loan. The reason for this is that a person with a new or numerous home loans have an increased financial burden, and they are less capable of honoring any new debts.

- Negative Status Accounts: This segment has a lower impact on your credit score. However a negative remark here could adversely affect your credit score. It is a count of all accounts that the lender has written off, filed a suit for, sold, etc as a result of non-payment. The higher the number of negative status accounts in your credit report, the lower your credit score. No account under this section is great for your credit report.

Being aware of your credit score at any given time is one of the requirements of a financially healthy lifestyle. Keep checking your credit score from time to time and especially before applying for a loan.

Chqbook promotes its visitors to make a well-informed decision and do as much research about their Home Loans and Credit Cards as possible. An informed borrower is a smart borrower!